Significance of Nigeria's Finance Bill for 2020 Budget.

The significance of the Finance Bill of 2020 presented to the National Assembly by President Muhammadu Buhari includes :

1. Increase in government revenue through the increase of the Value Added Tax (VAT) from 5% to 7.5%.

2. Introducing tax incentives for investment into infrastructure and capital markets.

3. Promote the ease of engaging in business activities especially by Micro, Small and Medium Enterprises (MSMEs).

4. Improving the domestic tax laws to align with the global best practice.

5. Promoting fiscal equity, especially in avoiding double taxation on Income generated by organizations.

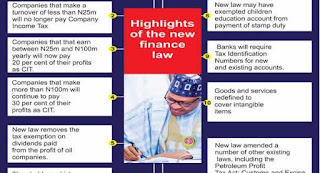

The finance bill made changes to different tax laws in Nigeria such as :

1. Increase in VAT from 5% to 7.5 %.

2. 0% Company Income Tax rate for small businesses and 20% for medium businesses. Therefore there is a bonus of 2% for companies that pay their taxes 90 days before the due date. This makes their tax percentage 18%.

3. Taxation of the digital economy.

Comments

Post a Comment