The Summary and Analysis of Nigeria's Budget For 2021

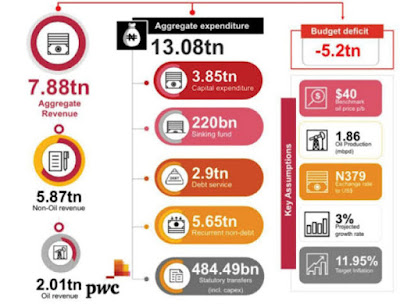

On 8th October, 2020, President Muhammadu Buhari presented the budget for 2021 to the Joint Session of the National Assembly. And it was tagged " Budget of Resilience and Economic Recovery" The components of the budget are as follows: 1. The budget has a deficit of 5.20 trillion, which is 3.64% of the GDP. 2. Non Debt Recurrent Expenditure amounted to N3.76 trillion which is the largest proposed government expenditure. The federal government planned to fully implement the Integrated Personnel Payroll Information System (IPPIS) to ensure the efficiency of the expenditure, in paying salaries of civil workers. Government owned enterprises are advised to seek approval before embarking on recruitment exercise. 3. The budget is to be financed by new borrowings, privatization proceeds and drawdown of loans secured for specific projects. 4. The capital expenditure is budgeted at N3.85 trillion which is about 43% increase of that of 2020 and 29% of total expenditure. 5. The aggrega